Case Study: How Mortgage Winners Saved Our Client $36k+ Using Manulife One

At Mortgage Winners, we’re excited to share how our Manulife One service helped a recent client significantly improve their financial

At Mortgage Winners, we’re excited to share how our Manulife One service helped a recent client significantly improve their financial

The recent interest rate cut announced by the Bank of Canada has ushered in a wave of optimism for the

If you’re a first-time homebuyer in Ontario, the federal government just gave you two powerful new tools to achieve your

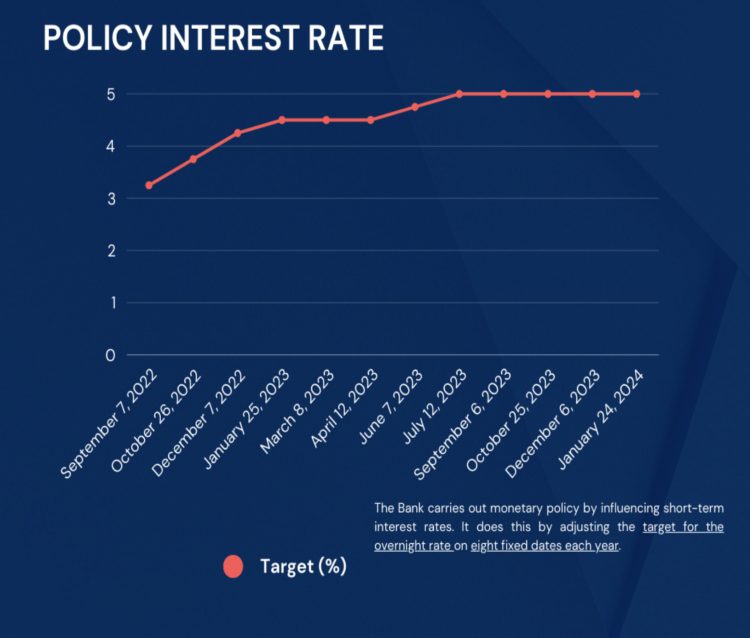

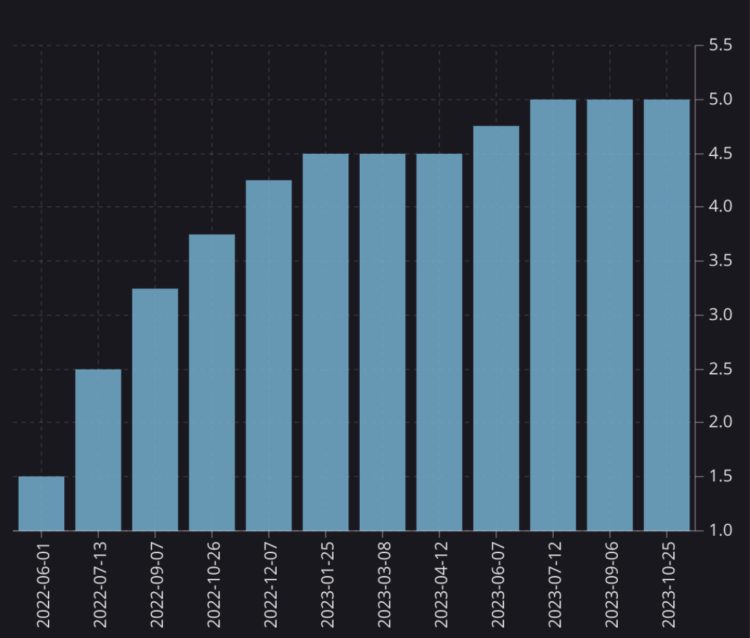

Bank of Canada Keeps Rates Steady at 5.00% The Bank of Canada announced that it would hold its overnight target

First-Time Homebuyer? Now is the Time to Buy in Ontario While Ontario’s housing market has cooled down from its peak,

Adjustable-Rate Mortgages: A Strategic Choice for the Future As a leading mortgage brokerage in Milton, Ontario, Mortgage Winners specializes in

The bank of Canada has chosen to hold its benchmark interest rate at 5.0% making it the fourth consecutive hold.

The real estate landscape in Ontario is experiencing significant changes, with the implementation of Phase 2 of the Trust in

As your Principal Broker at Mortgage Winners, I personally want to ensure that you are informed about the latest developments

The Bank of Canada kept its key interest rates steady at 5%, maintaining its policy of reducing its balance sheet.