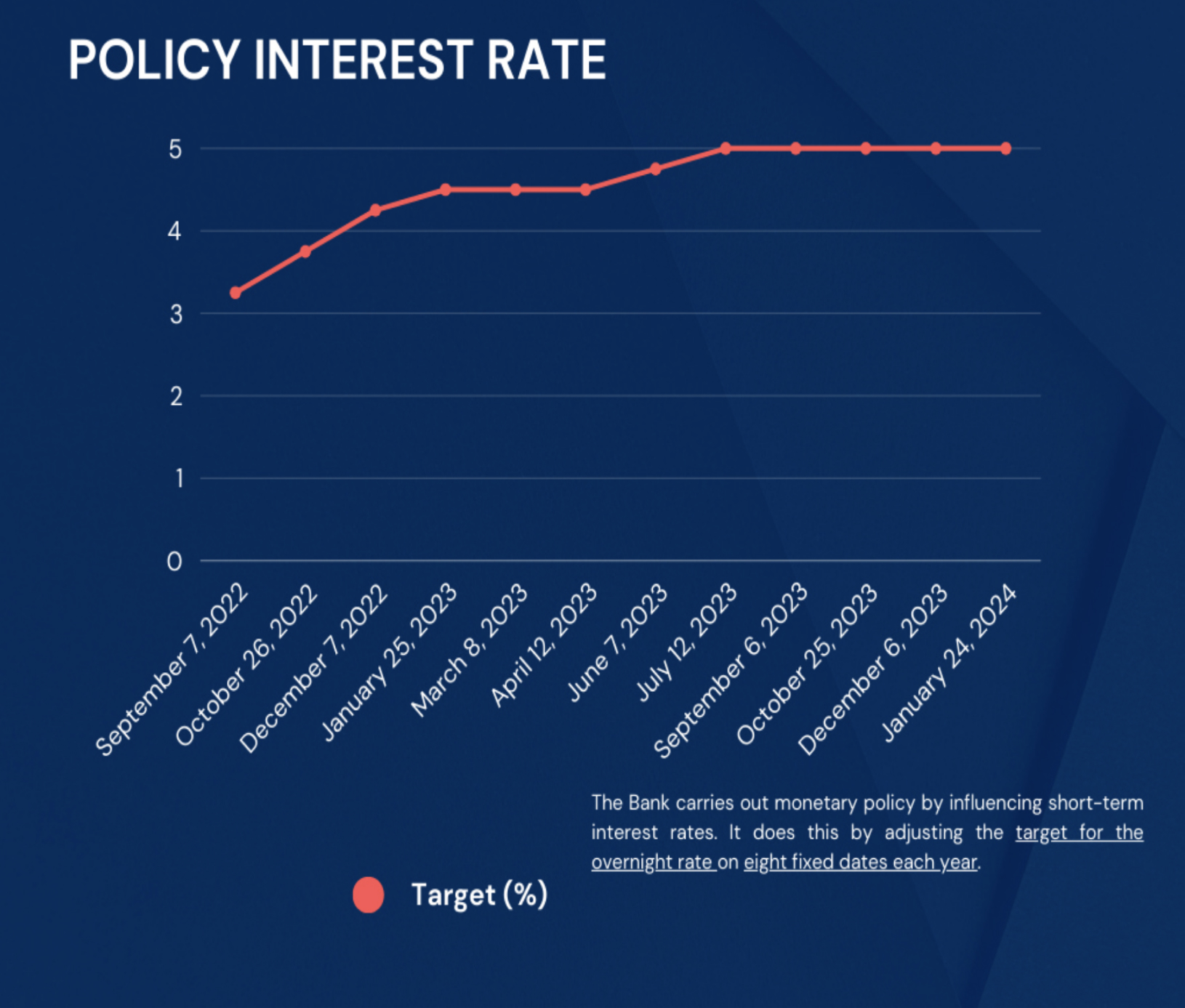

The bank of Canada has chosen to hold its benchmark interest rate at 5.0% making it the fourth consecutive hold. This decision was widely anticipated by economists. Inflation continues to be challenged by gas prices, airfares and housing costs which have contributed to Canada’s annual inflation rate reaching 3.4% in December up from 3.1% in the previous month.

This increase poses challenges for the bank of Canada and its efforts to bring inflation closer to its target of 2%. The bank of Canada remains vigilant about potential risk to the inflation outlook. Market analysts are still currently anticipating rate decreases in the second half of 2024; that trajectory could change depending on how economic trends and metrics continue to progress.

The prime rate, on which lenders base their variable rate offerings to consumers, remains at 7.2%.

Fixed rates are more influenced by the bond market. The best fixed rates today are 4.4%-6% depending on the borrower. Fixed rate offerings are subject to change daily by lenders.

The next interest rate announcement is scheduled for March 6th 2024.