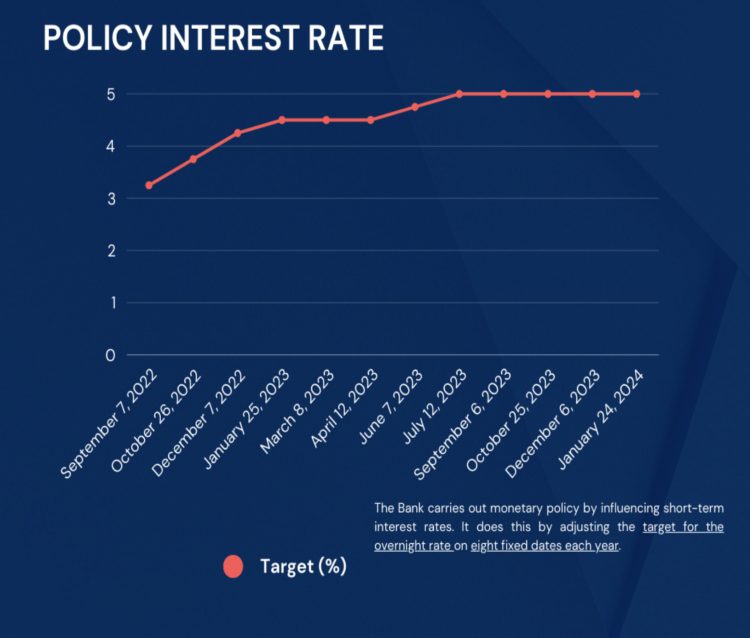

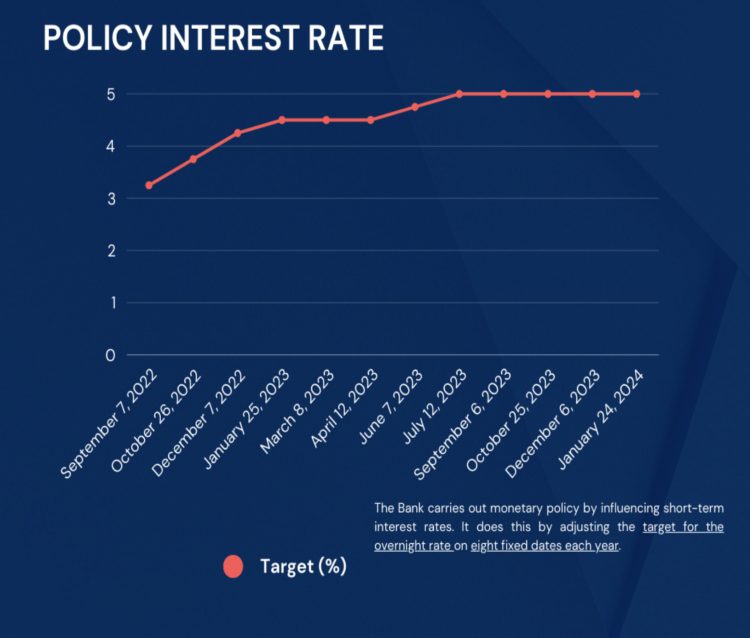

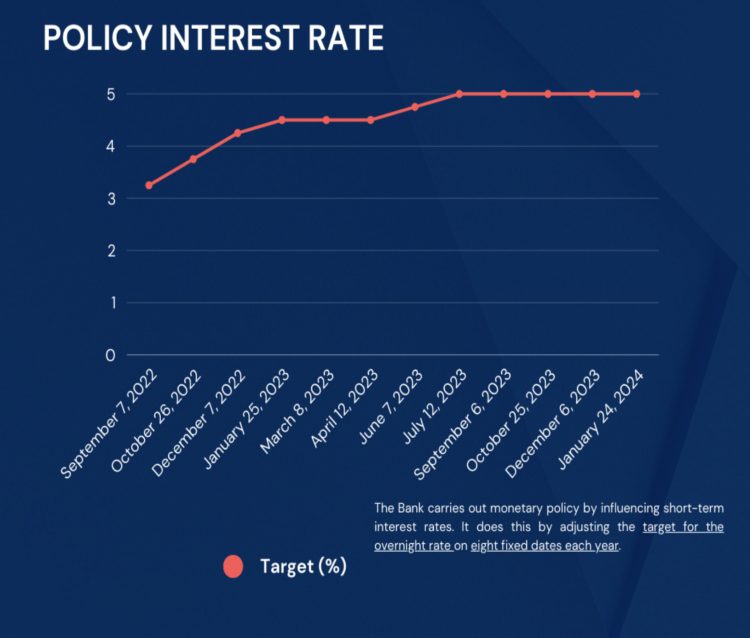

The Bank of Canada holds Interest Rates at 5%

The Bank of Canada has decided to keep its overnight rate target at 5% today. Canada’s inflation rate rose to

The Bank of Canada has decided to keep its overnight rate target at 5% today. Canada’s inflation rate rose to

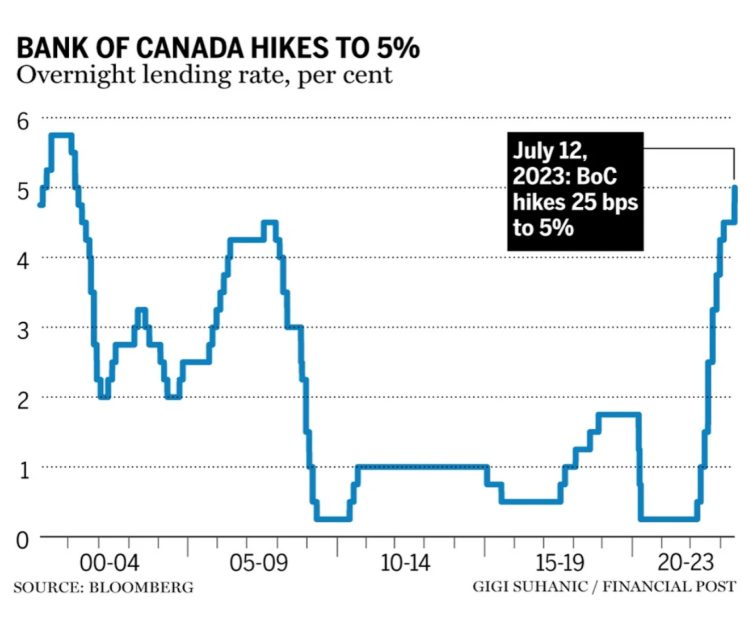

On Wednesday, the Bank of Canada decided to raise its benchmark interest rate by 25 basis points to reach 5%.

The Bank of Canada lifted its interest rate hold on Wednesday, raising it by 25 basis points to 4.75 percent.

The Bank of Canada has once again left its overnight target rate unchanged at 4.50%. This is the Bank’s second

For the first time in a year, Canada’s central bank has opted not to increase the overnight lending rates, maintaining

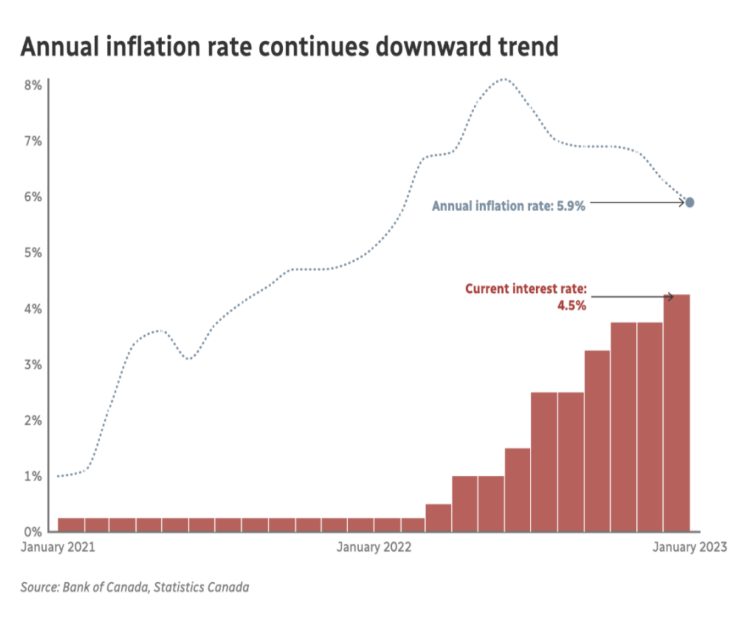

Statistics Canada reported that Canada’s inflation rate slowed to 5.9% in January, lower than the 6.2% expected. The price of

The Bank of Canada raises the key interest rate by 25 basis points. The Bank of Canada lifted its overnight

Happy Holidays from everyone at Mortgage Winners! Thank you for your continued support and dedication throughout the year. Wishing you

As a result of its annual review, the Office of the Superintendent of Financial Institutions (OSFI) announced the Minimum Qualifying

The Bank of Canada raised interest rates aggressively for the sixth time in a row, while hinting that it may