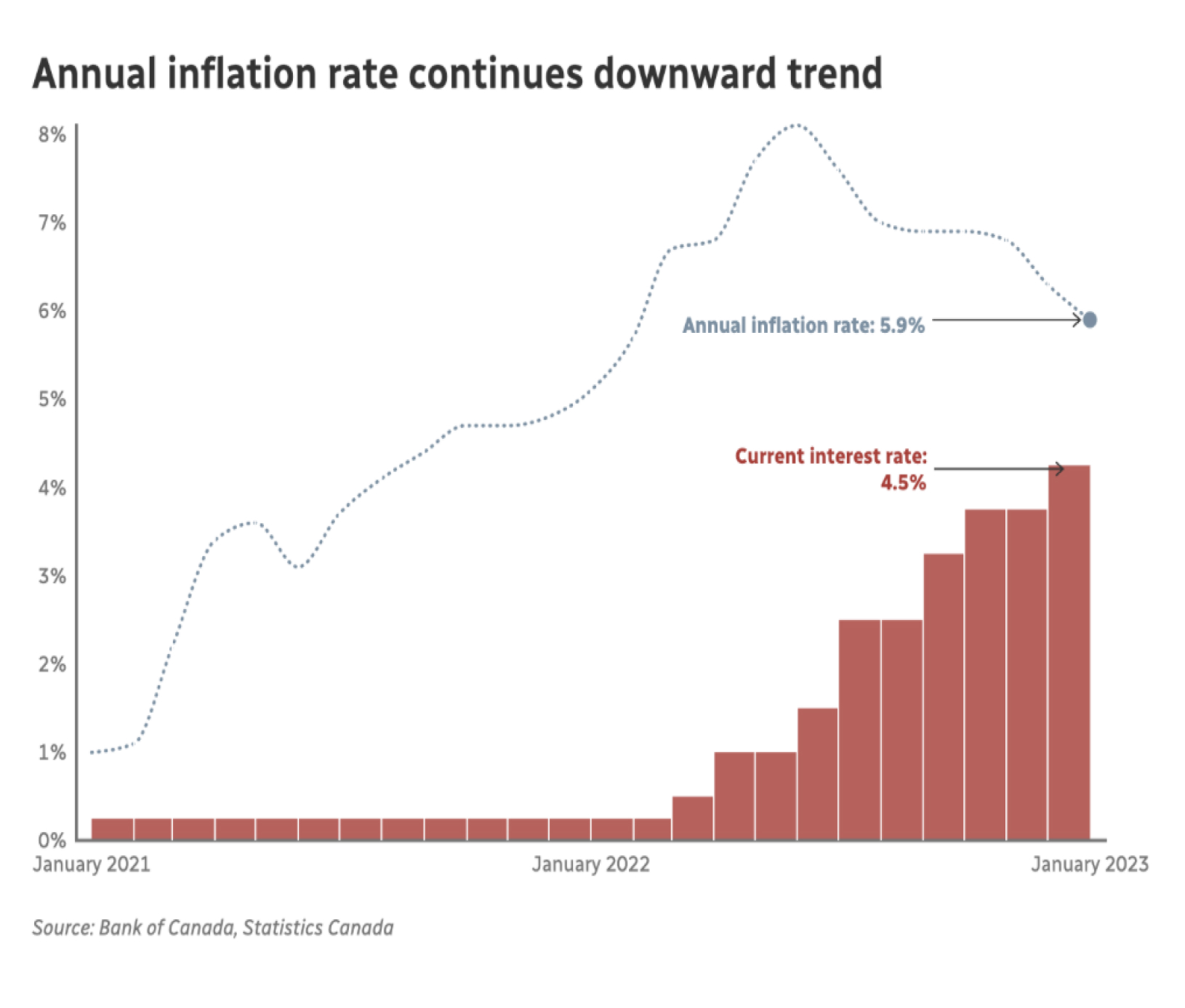

Statistics Canada reported that Canada’s inflation rate slowed to 5.9% in January, lower than the 6.2% expected.

The price of groceries continues to accelerate and mortgage interest costs continue to rise. The most significant increase since September 1982 the Bank of Canada is trying to tame inflation with higher interest rates.

According to Doug Porter, chief economist at Bank of Montreal, January’s results were “a rare downward surprise” and a move in the right direction.

The drop comes a little under a month after the central bank indicated that it will halt further interest rate increases. It hiked the benchmark interest rate to 4.5 percent during that January meeting, the seventh rise in less than a year.

The consumer price index rose 0.5% in January compared with December, driven by higher gas prices.

The cost of dining out rose at a faster pace and consumers paid less for cellular services. Prices for passenger vehicles also slowed on a year over year basis, partly due to base-year effects.

The next announcement of the overnight rate goal is set on March 8, 2023. On April 12, 2023, the Bank will publish its next comprehensive prognosis for the economy and inflation.

To explore options to improve your cash flow, click here.