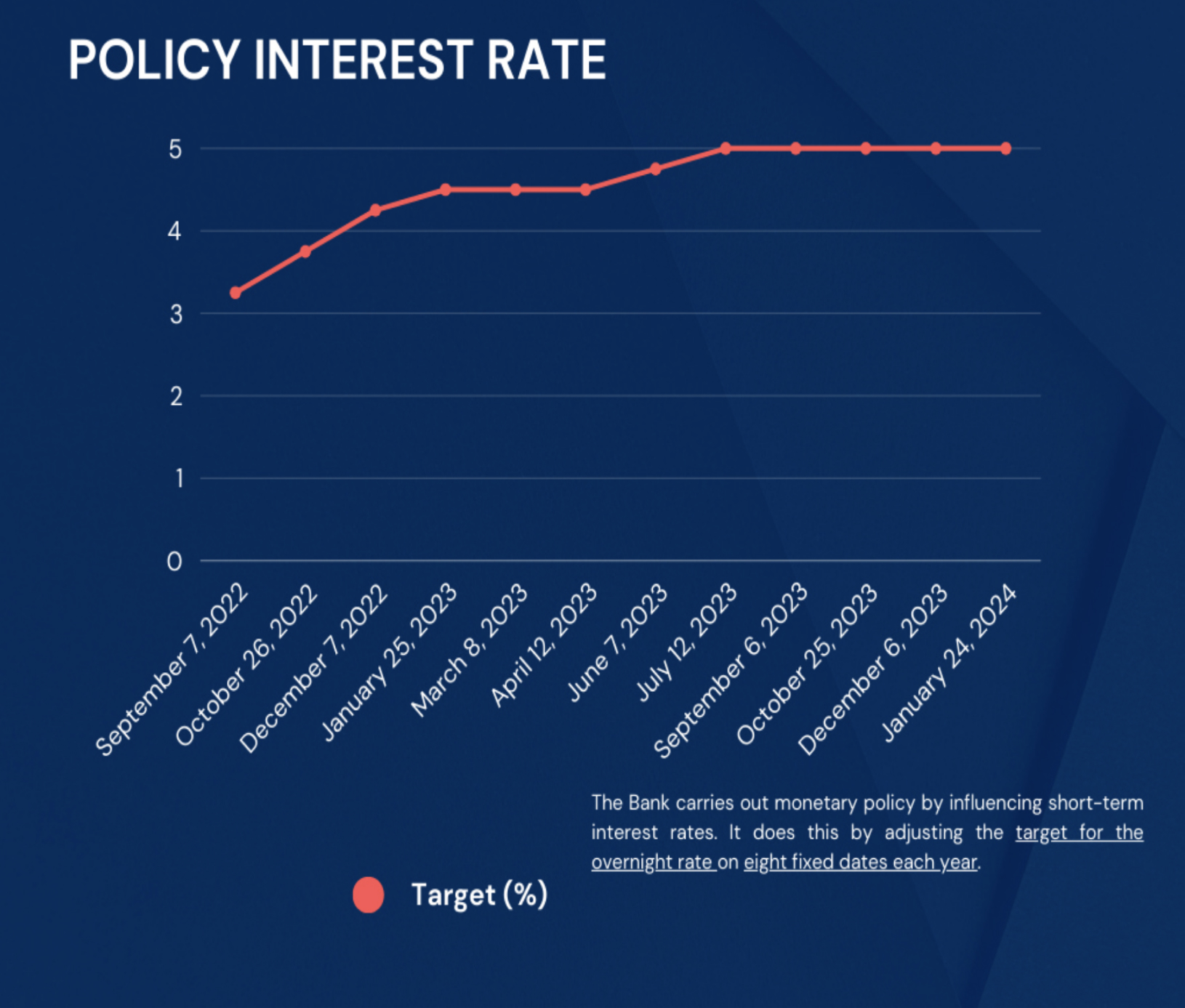

The Bank of Canada lifted its interest rate hold on Wednesday, raising it by 25 basis points to 4.75 percent.

The policy rate has now reached its highest level since April 2001.

Canada is seeing substantial inflation for the first time in a generation. Goods and service costs have grown quickly over the last two years, undermining the buying power of the Canadian dollar and making living less affordable for Canadians.

The Bank of Canada uses interest rates to keep inflation under control. By boosting interest rates, the bank makes borrowing money and servicing loans more expensive for individuals and companies. This decreases demand for products and services, which should moderate the rate of price rises.

Between March 2022 and January 2023, the bank hiked its benchmark rate eight times, marking one of the quickest monetary policy tightening cycles on record.

Most Canadians are exposed to interest rates through mortgages and other kinds of consumer debt, such as credit cards, personal loans, and vehicle loans.

The prime rate, which commercial banks use to set interest rates on variable rate mortgages and home equity lines of credit, has increased to 6.7% from 2.45% in 2021. Fixed-rate mortgage interest rates have also climbed.

The next interest rate update is on July 12.

To explore options to improve your cash flow, click here.