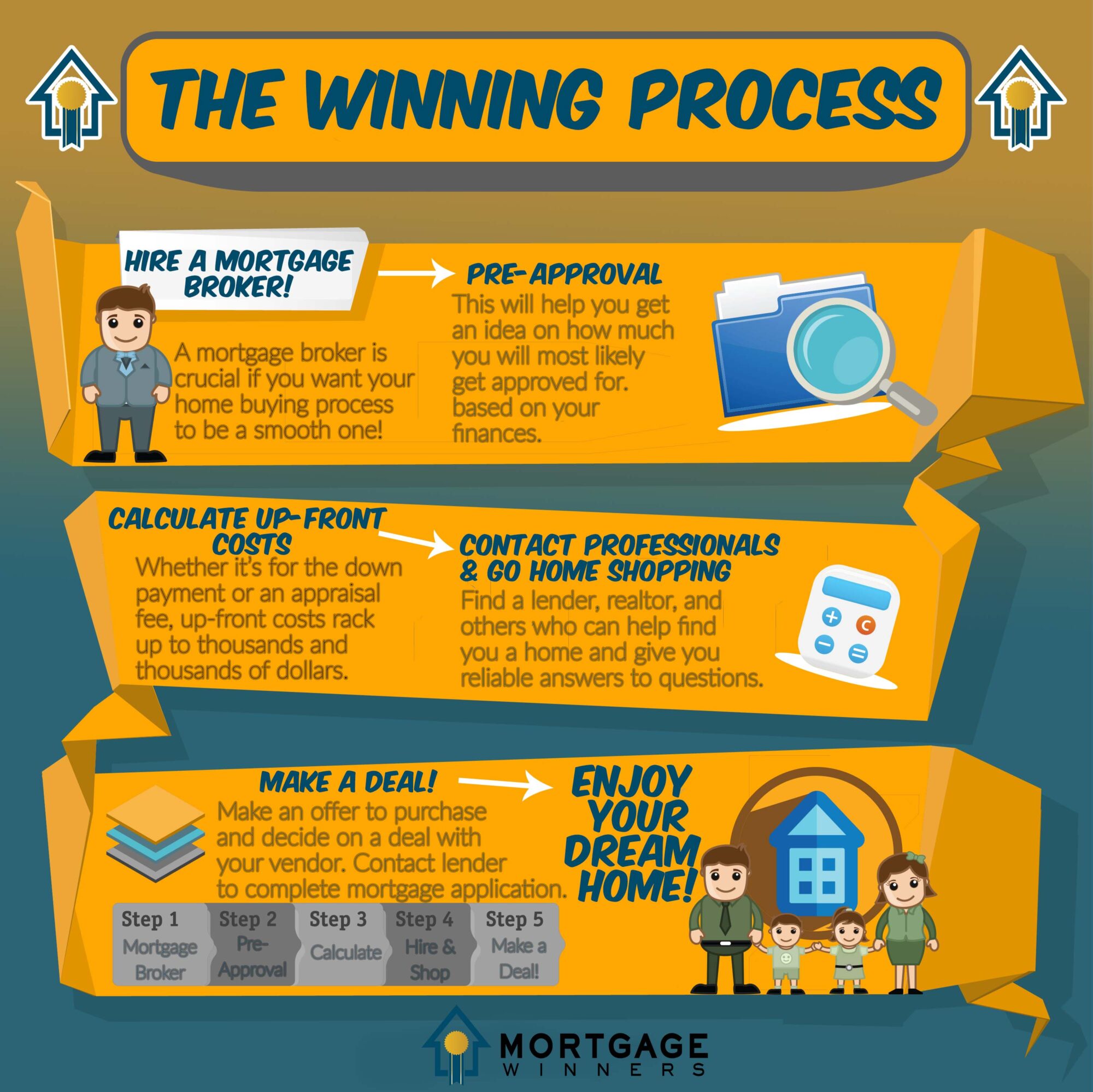

Getting a mortgage may seem like a daunting process, but with the right expertise and a step-by-step guide, it can be a fun and exciting experience! The Mortgage Winners team is here to give you the inside scoop and know-how capability on mortgages so that you can feel confident in beginning your home buying journey. Put your reading glasses and thinking caps on folks, because this five-step guide is sure to put all of your concerns to bed!

1) Hire a Mortgage Broker

Many people don’t realize that hiring a mortgage broker is the best thing you can do to attain the best rates and mortgage solution possible. With their insider tips and tricks, mortgage brokers can scrounge for deals that might not be readily available to you. They assess all your finances and distinctive requirements so that they can grant you the best mortgage strategy. Once they find you the right lender, they become the intermediary between you and that lender.

Now, you might be wondering how much you would need to pay a mortgage broker to receive this amazing service. The answer to that question is NOTHING! Most of the time, mortgage brokers are paid commission through the lender. Sometimes there may be a small fee depending on your credit history.

Hiring a mortgage broker is a crucial step that will save you an immense amount of money, time, and effort.

2) Pre-Approval

While getting pre-approved does not guarantee getting approved for a mortgage, it is necessary so that you have an idea of how much of a loan you’re most likely to get. A lender will scan over your financial status, amount of down payment, etc., and calculate an estimated loan amount based on all of these factors. However, make sure you understand that the estimated loan amount given to you is just that – an estimate. If you are not happy with the amount you are pre-approved for, your mortgage broker can work to give you an amount closer to what you want. When it comes to mortgages, negotiating is the number one key element that can make it or break it for first-time homebuyers.

3) Calculate Up-Front Costs

Forecasting and accounting for up-front costs in the early stages of planning will make sure everything goes smoothly. We don’t want you to experience any undesirable surprises, so we are telling you in advance that costs can rack up to quite the hefty amount. From the down payment, deposit, and appraisal fee – to paying a moving company on closing day, being prepared is necessary for an effortless transition.

4) Contact Professionals and Go Home Shopping

You have already hired a mortgage broker, but there are several others you may want to contact. Putting together a team of professionals who know what they’re doing will guarantee a flawless process. You may need an appraiser, land surveyor, building contractor, lawyer, lender, and realtor. These experts are qualified to help you with very specific aspects of purchasing a home, and can answer all of your questions so that you are not left in the dark.

All of these experts can help you decide on a home that’s right for you, but a realtor is best able to help you do this. Firstly, you and your family should decide on the size, location, and house build that best suits you, while simultaneously accounting for any future lifestyle changes. Factors you may want to consider are how big your family will grow, or what direction your career is most likely to take. Analyzing all of these aspects with your realtor will help you make an informed and correct decision when shopping for your home.

5) Make a Deal

After your vendor accepts your offer to purchase, go to your lender so that you can complete your mortgage application. This will be where you officially decide on the payment details. If you have hired a mortgage broker, they will strictly deal with your lender so that the best mortgage solution is decided on. This is the step where the length of your amortization period, type of mortgage, and payment schedule is finalized.

Now that you have successfully completed all of these steps, just wait until closing day. Closing day is the day where you take legal possession of your new home!

If you have any more questions, don’t hesitate to contact us here at Mortgage Winners. We hope you have a lovely week!